The 30-year fixed-rate mortgage this week fell to its lowest average on record—3.29%—since Freddie Mac began tracking such data in 1971. And borrowers rushed to lock-in.

Mortgage applications rose 10% last week compared to a year ago, says Sam Khater, Freddie Mac’s chief economist. “Given these strong indicators in rates and sales, as well as recent increases in new construction, it’s clear the housing market continues to be a positive force for the broader economy,” he adds.

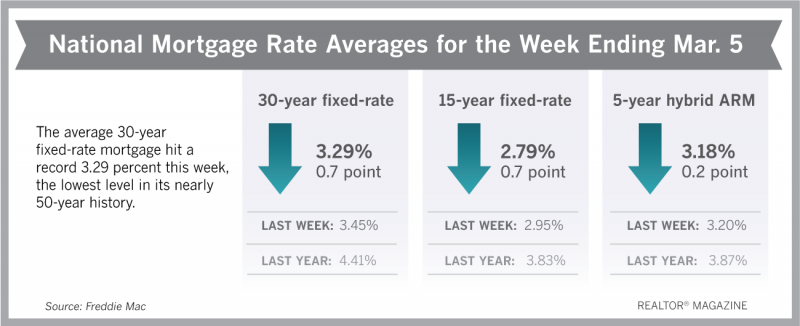

Freddie Mac reports the following national averages with mortgage rates for the week ending March 5:

- 30-year fixed-rate mortgages: averaged 3.29%, with an average 0.7 point, falling from last week’s 3.45% average. Last year at this time, 30-year rates averaged 4.41%.

- 15-year fixed-rate mortgages: averaged 2.79%, with an average 0.7 point, falling from last week’s 2.95% average. A year ago, 15-year rates averaged 3.83%.

- 5-year hybrid adjustable-rate mortgages: averaged 3.18%, with an average 0.2 point, falling from last week’s 3.20% average. A year ago, 5-year ARMs averaged 3.87%.

Source: Freddie Mac